Trading app Robinhood has announced several changes to its platform after the apparent suicide of a 20-year-old student over a negative balance of $730,000 on his account.

The death of 20-year-old Robinhood trader Alexander Kearns, which is being treated as suicide, has prompted the trading app to announce plans to introduce improvements in its user interface.

Suicide over negative balance

Kearns, who had been using Robinhood to trade complex options instruments, was found dead on June 12 in Plainfield, Illinois. While factors that contributed to his death remain unclear, it has been ruled a suicide according to his family and Robinhood.

The young trader's death has emphasized the potential dangers of the free-trading boom inspired by Robinhood. The trading app gave first-time investors easy access to exotic financial instruments typically used by sophisticated investors.

The Kearns family believes that the app's interface misled Alexander to believe that he owed $730,000, when that was not really the case.

Bill Brewster, a cousin-in-law of Kearns, said: "The kid threw himself in front of a train over nothing, because a tech company can't figure out they shouldn't show a negative $730,000 cash balance to a 20-year-old kid."

"How much are these guys thinking about the fire they are playing with?" Brewster added.

He vowed to do whatever it takes to draw attention to what he deems as serious lapses on the part of Robinhood that allowed for the incident to happen. He said: "This company is toxic to me right now."

Confusion with the app

Brewster tweeted a note he claims Kearns left behind before his death, which showed that he was distraught and confused over his Robinhood account. Brewster argued: "How was a 20-year-old with no income able to get assigned almost a million dollars' worth of leverage?"

In the note, Kearns stated: "The puts I bought/sold should have cancelled out, too, but I also have no clue what I was doing now in hindsight."

Brewster admitted that he initially thought Robinhood had improperly given Kearns huge amounts of leverage to trade with but realized it was not the problem.

Some of those who read the tweet explained to him that options traders on Robinhood sometimes see a negative cash balance until the other half of their trades are executed.

It meant that Kearns did not actually owe $730,000 but was apparently led to believe he did.

Brewster pointed out: "My sense is that it was all over nothing. It was a user interface issue."

He blamed the company for pushing the product to young traders without placing safeguards to prevent confusion.

"That they didn't have enough foresight to think this might happen is offensive to me," he said.

Robinhood's response

Following Brewster's long Twitter thread about Kearns' death, the company announced a series of changes to its options offering and user interface directly in response to the incident.

Robinhood pledged to do more to explain how these sophisticated trading strategies work.

Robinhood's co-founders and co-CEOs Vlad Tenev and Baiju Bhatt wrote a blog post on Friday confirming that Kearns was a client and said, "We are personally devastated by this tragedy."

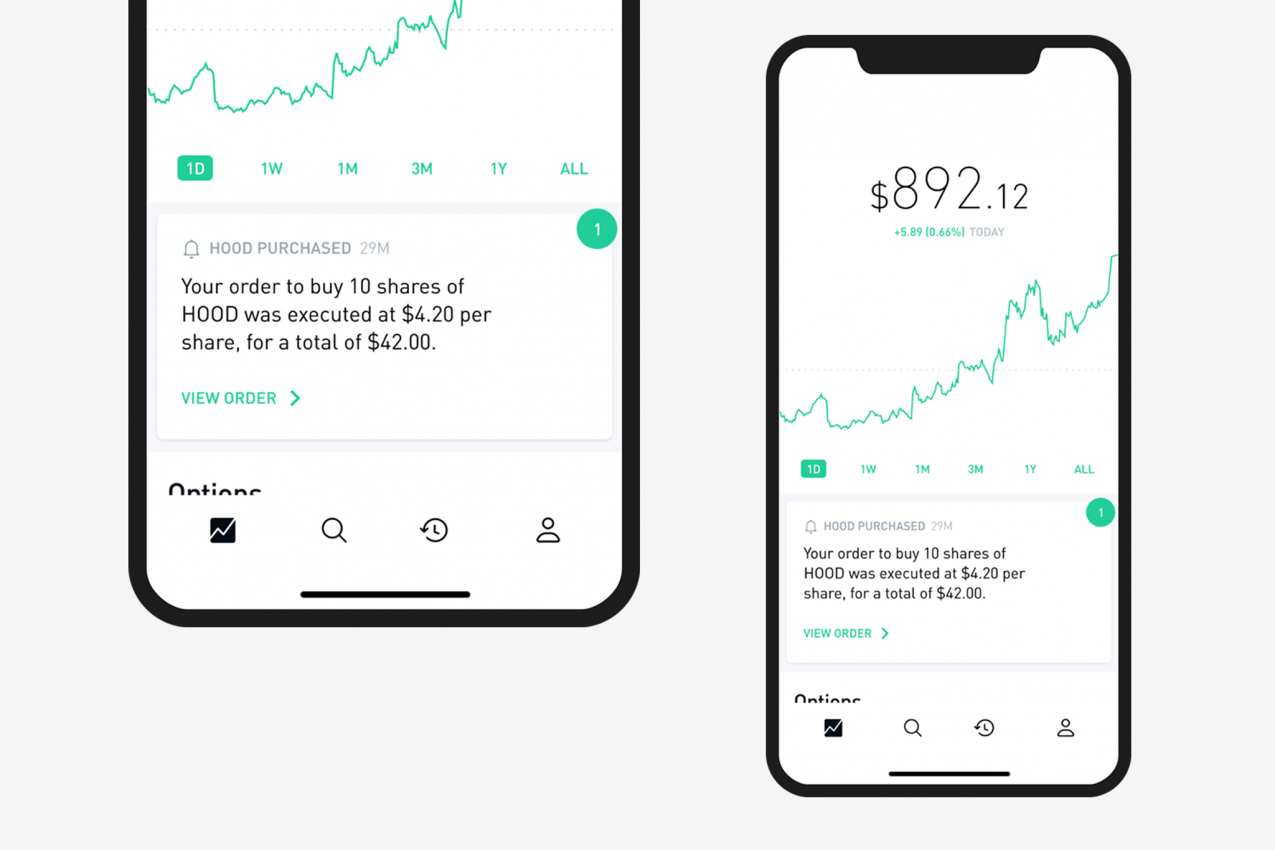

The company's planned changes include the way buying power is displayed.

Robinhood said it would also improve its in-app messages and emails that get sent to customers about options transactions as well as changes to the in-app history page to help users "understand the mechanics" of options trades.